Add Guarantees To Your Retirement

How Life Insurance & Annuities can complement or be the foundation for your retirement

Most of us are familiar with the more common ways of saving for retirement. Whether contributing to an employer’s retirement plan (401k, 403b, etc.) or to an individual retirement account (IRA), using life insurance and annuities are commonly overlooked as ways to both grow and protect future retirement. These tools can provide many significant benefits that the previously listed ways of saving for retirement cannot.

Let's dive into some key benefits of using Life Insurance and Annuities as a cornerstone in your retirement.

Index Universal Life Insurance (IUL)

IULs were first introduced to the market in the late 90’s. They provide a way for people to have the benefits of a life insurance policy while simultaneously growing their wealth through cash value accumulation. In a IUL a portion of the premium you pay is allocated to a cash value account that is tied to one or more indexes. These indexes then participate in the growth of the market locking in your gains year after year. In the event the markets experience a downturn, you do NOT participate in market losses, ONLY in market gains. Imagine your retirement account never losing money due to a down market or recession, your principal and interest is protected at all times eliminating ALL downside market risk.

In addition IUL’s do not have the same restrictions of not being able to access your funds until you’re 59 1/2 years old, typical of an employer 401k retirement plan or a personal traditional IRA. Instead you are able to access the funds at any point in time. This is great for people who may need to dip into their cash value account for unexpected life events, a potential investment opportunity, buying that new car or house, a children’s college education, or even an early retirement.

IUL’s are even more lucrative for people looking to contribute more to their future retirement by not having any contribution limits, like a 401k or IRA which limits your contributions of up to $23,000 and $7,000 per year respectively as of 2024 if under the age of 50. On top of that, they also eliminate advisory/management fees which are fees that a financial advisor or money manager charges your account to manage what investments your money is allocated into - in many cases this is a fee that you could end up paying even in the event your account is underperforming.

Lastly IUL’s can offer major tax advantages in the future as the money that accumulates in the cash value account can be accessed Tax Free. Therefore if you’re one of the millions of Americans who think taxes will be higher in the future than where they are now you should seriously be consider using an IUL for your future retirement income. Many IUL’s can also come with a lifetime income feature which allows the owner to take guaranteed lifetime income payments from their IUL even if the policy’s cash value reaches zero.

Remember, at the end of the day this is still a life insurance product that will provide you and your loved ones with a death benefit in the event you passed away. In many cases at no added cost, you will have living benefits that give you access to your policy’s death benefit while you are still alive in the event of critical, chronic, or terminal illness. For more information on it’s uses, see Life Insurance.

IUL

Retirement Benefits

Accessible without early withdrawal penalties

No contribution limits like traditional retirement plans

Cash Value Accumulation can be used for Tax Free Retirement Income

Multiple indexed account options for allocation of funds

Principal Protection

No Market Loss

No Advisor Fees

Guaranteed Lifetime Income Features

Avoids Probate

Critical, Chronic, & Terminal Illness Benefits

Waiver of Premium due to disability features

Death Benefit

Annuity Retirement Benefits

Grows Tax Deferred

Avoids Probate

Principal Protection

No Market Loss

No Advisor Fees

Guaranteed

Lifetime Income Features

Nursing, Confinement, & Terminal Illness Benefits

Death Benefit

Options for Fixed Rate of Return (Fixed Annuity)

Multiple indexed account options for allocation of funds (Fixed Index Annuity)

Annuities

Annuities have been around much longer than you may think, dating back as far as the Roman Empire. They were used to pay the Roman soldiers in exchange for their military services. During the Middle Ages annuities were used by lords and kings to help raise capital to cover costs of wars and conflicts with one another. Fast forward to 1720 when one of the early recorded uses of annuities in the United States was by the Presbyterian Church used to provide a secure retirement for aging ministers and their families as well as widows and orphans. Then in 1812, Pennsylvania Company Insurance was one of the first to begin offering annuities to the general public in the United States. You may know someone who has worked for a company for a long time and is now retired and receives a pension which is in fact an annuity that provides them with a fixed monthly payment of income for the duration of their life after retiring. We are telling you all of this to say that Annuities are not new and have been around and used successfully in history for centuries and are still being used today all around us.

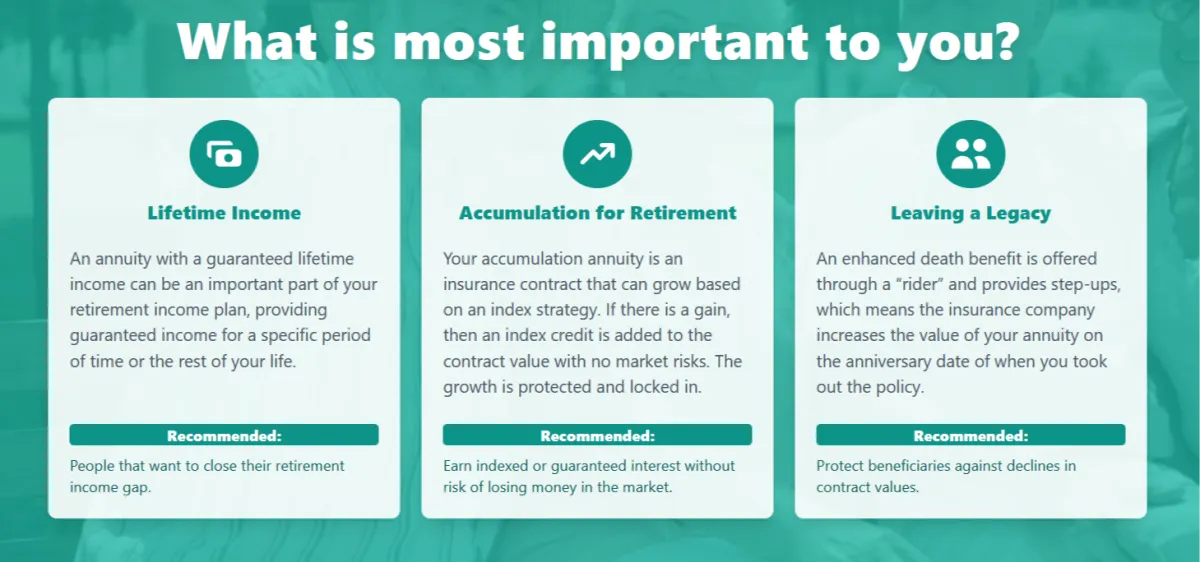

There are three different types of annuities; Fixed Annuities, Fixed Index Annuities, and Variable Annuities. The first two types mentioned focus on protecting and growing your principal by eliminating any potential losses in the market while the last type subjects you to market losses. Our focus for our clients is on safe money retirement strategies which is why we only offer the first two options for client’s who are looking to eliminate downside market risk. With both of these strategies you are able to grow your money tax deferred, eliminate management and advisory fees, eliminate downside market risk, and in some cases guarantee lifetime income for the annuitant (owner of the annuity).

Fixed Annuity (FA)

With the oldest type of annuity that has been around for centuries, you are able to grow your principal at a guaranteed fixed rate of return for a number of years. This will depend on what company the annuity is with, their product line they offer, their current fixed rate of return for that product, and the duration of the annuity itself. This is a great option for someone who isn’t trying to beat the market but wants guaranteed steady rates of return year after year allowing them to grow their account with certainty and predictability.

Fixed Index Annuity (FIA)

With this type of annuity you are able to take advantage of the potential upside in the market without worrying about the downside losses in the market. You are able to get market like returns without taking on the risk of losing your principal or gains in the process. Many of our clients gravitate towards an FIA because it has the potential to make higher returns than those typically offered in a Fixed Annuity while still giving them the guarantee of their principal and locking in their gains year after year. Much like an IUL, the FIA is tied to one or more indexes offered by the annuity company which allows the annuitant (owner of the annuity) the ability to diversify within the annuity itself and capture the upside gains from multiple different indexes. We always believe in diversification and that having all of your eggs in one basket when it comes to investing in your retirement is never the best way to build your wealth.

Your annuity payouts or distributions could contribute to medical expenses, a mortgage or living expenses, a vacation, or a child’s college education. Annuities can also be used to supplement income you receive from other retirement funds or Social Security.

Schedule a consultation to speak to a retirement specialist today to learn how an IUL or Annuity could help you build a better and more worry free/secure retirement.

Contact Info

30 N Gould St. Ste R, Sheridan, WY 82801

Your future doesn’t fit into someone else’s mold… Let us help design yours…

(508) 808-4718

Useful Links

© Copyright 2022 Significant Life LLC. All Rights Reserved.