Common & Surprising Ways To Use A Life Insurance Policy

Common Ways To Use A Life Insurance Policy

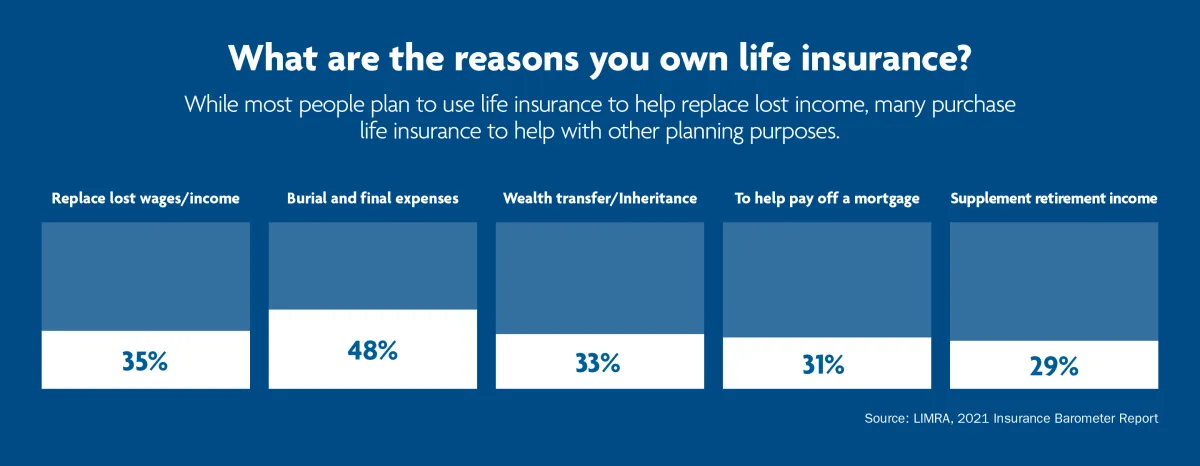

The three most common ways people use life insurance are...

Income Replacement

Replace the loss of income from the insured for a designated number of years.

Mortgage Protection

Pay off the mortgage loan of the insured in order to guarantee the home is passed to the designated beneficiaries with little to no financial burden left behind.

Final Expenses

For funeral and burial costs of the insured once they pass away.

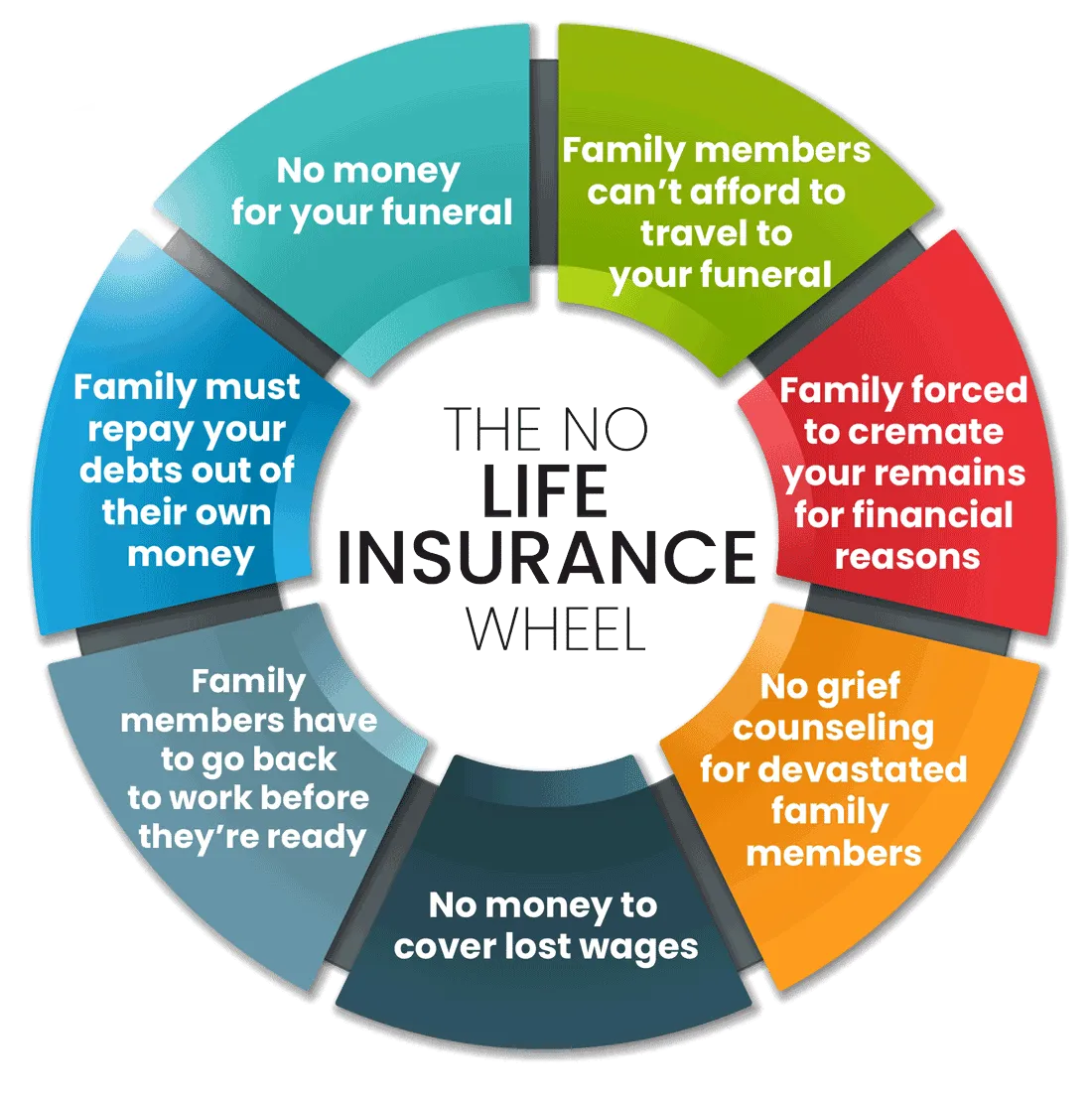

While most people understand the importance of life insurance as a necessary tool in the event of a death, many people often forget the many advantages their policy can offer while they’re alive. Read on to see how your policy can protect your loved ones and your finances throughout your life.

Surprising Ways To Use A Life Insurance Policy

Access living benefits

Living benefits are a type of life insurance rider and a popular option for individuals who want to reap the benefits of their policy while they are alive. Living benefits allow for a portion of the policy’s death benefit (the lump sum your beneficiary would receive if you were to pass away) to be paid in advance in certain situations.

Popular living benefit riders include chronic illness benefits which are paid out if you are unable to meet two of six daily living activities. Critical illness benefits which are paid out if the insured suffers from things like a heart attack, stroke, organ failure/transplant, internal cancers, and more. Terminal illness benefits which are paid out if the insured is diagnosed terminally ill with a life expectancy of 24 months or less to live. A long-term care benefit, which could be used to cover major medical and care expenses later in life.

You may also consider a waiver of premium rider, which could allow you to skip premium payments on your policy if you become disabled and cannot work. Living benefit riders can provide safeguards for your income if you face an unexpected injury, illness or diagnosis.

Fund your retirement

Life insurance can also be used to save for retirement with many advantages not available in traditional retirement vehicles such as a 401(k) or IRA. If you already have retirement vehicles such as a 401(k) or IRA, or you’re looking to improve or start your retirement savings, an Indexed Universal Life (IUL) Insurance or Annuity would be the perfect fit.

With an IUL you won't have to worry about contribution limits, losses in the market, or management/advisory fees. In addition you can use this to build a tax free retirement in the future. With an annuity, you won’t have to withdraw a specific amount each year as you would with an IRA, and you won’t have to face the risk of market loss in the event of an economic downturn similar to an IUL. During the accumulation period, you would make a lump sum or series of regular payments to fund your annuity. When you’re ready to start receiving payments, you would “annuitize” your contract and the insurance company would provide payments on a schedule you choose.

Your annuity payouts could contribute to medical expenses, a mortgage, a vacation, or a child’s college education. Annuities can also supplement payouts you receive from other retirement funds or Social Security. You can learn more about how IUL’s and Annuities can be a key component in your overall retirement plan by visiting our Retirement Planning page.

Pay off debts

You might be wondering how life insurance can help you become debt free – and the solution is Debt Free Life. This program has been modernized to meet the needs of individuals by harnessing the cash value of a permanent life insurance policy.

Instead of borrowing from a bank and paying interest, you can use funds from within your life insurance policy to eliminate debt and build wealth over the years.

Debt Free Life can help you pay off many types of debt in a way that makes sense for your budget and goals, including credit card debt, mortgages, student loans and auto loans.

Don't Wait - Request a Quote Today!

Contact Info

30 N Gould St. Ste R, Sheridan, WY 82801

Your future doesn’t fit into someone else’s mold… Let us help design yours…

(508) 808-4718

Useful Links

© Copyright 2022 Significant Life LLC. All Rights Reserved.